The global halal industry is garnering some of the best growth potential; and Asia, home to 65 percent of the world’s Muslims, is well placed to tap on the substantial escalation of the industry.

Making up 1.9 billion or 24.7 percent of the world population, Muslim consumers are a rapidly growing segment that cannot be overlooked. This figure is expected to rise to 2.2 billion in 2030 and to 2.6 billion in 2050, making up 30 percent of the world population. The State of the Global Islamic Economy Report 2022 highlights that Muslim spend is forecasted to reach US$2.8 trillion by 2025 at a 4-year Cumulative Annual Growth Rate (CAGR) of 7.5 percent.

Investments in the Islamic economic sectors across Organisation of Islamic Cooperation (OIC) and select non-OIC markets grew by 118 percent to US$25.7 billion in 2020/21 from US$11.8 billion in 2019/20. Apart from the UAE, the other two countries which saw the highest number of investments were Indonesia and Malaysia. The spike in investors’ confidence in the thriving industry is driven by data that reveals how robust the halal industry is. Just on halal food alone, the global market reached a value of US$1.27 trillion in 2021 and is forecasted to reach US$1.67 trillion by 2025.

The halal industry is not limited to food, though halal food is the second biggest sector after Islamic finance. Other sectors include fashion, media and recreation, travel and pharmaceutical and cosmetics. The latest State of the Global Islamic Economy Report also points out that Muslims spent the equivalent of US$2 trillion in 2021 across those sectors, all of which are impacted by Islamic faith-inspired ethical consumption needs. Global Muslim spending in 2022 is forecasted to grow by 9.1 percent for the Islamic economy sectors, excluding the Islamic finance sector.

Kerry, the leader in the development of taste and nutrition solutions for the food, beverage and pharmaceutical markets, reports that global product launches with halal claims jumped by 19 percent from 2018 to 2020, from 16,936 products to 20,482, and a remarkable 63 percent of these came from Asia.

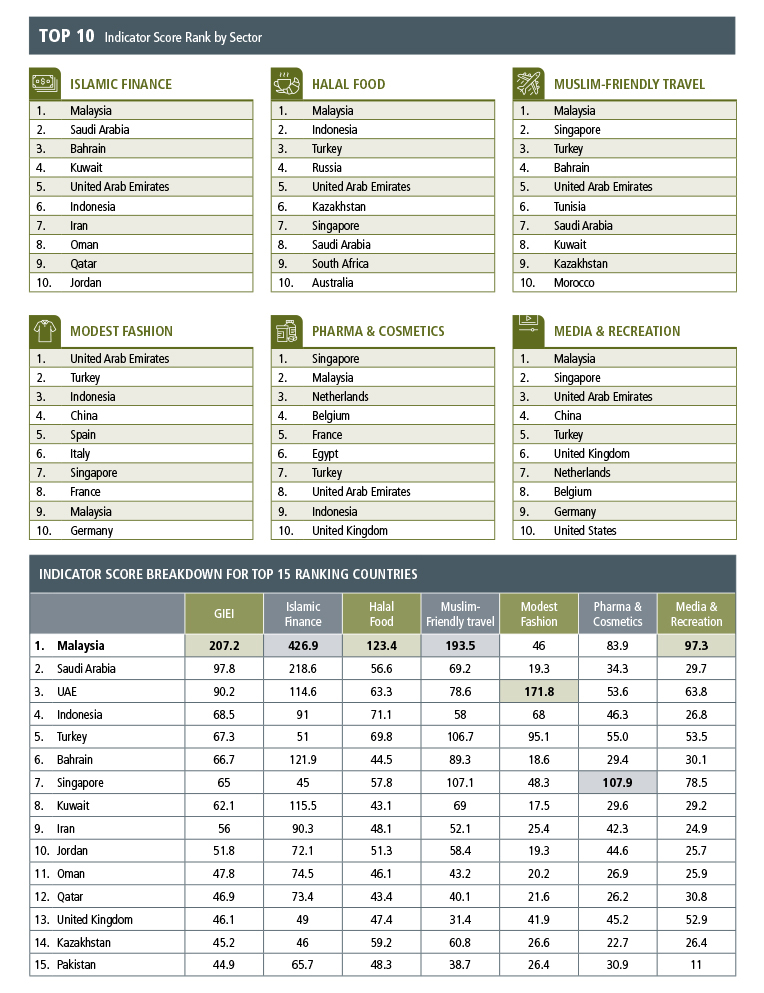

Countries in Southeast Asia in top 15 ranking of GIEI

Leading the charge in the overall GIEI rankings is Malaysia which, for the ninth consecutive year, has emerged the top nation that best supports the multi-trillion dollar global Islamic economy. The country takes the lead in Islamic Finance, Halal Food, Travel, and Media and Recreation.

The halal industry of Malaysia is growing rapidly, and, in 2020, this industry contributed around 8.1 percent to the country’s Gross Domestic Product (GDP). According to Halal Industry Development Corporation (HIDC), Malaysia’s halal industry market value is expected to reach USD 147.4 billion by the end of 2025.

The country with the largest Muslim population in the world, Indonesia, retains its 4th position in the overall GIEI ranking and takes the second spot in the Halal Food indicator ranking. Halal food exports to OIC countries increased by 16 percent. With Muslim comprising 87 percent of the country’s total population, the potential for growth is massive.

The government demonstrated its determination to develop the halal industry by passing the Halal Product Law. The law which kicked in in 2019 requires many consumer products and related services in the country to be halal-certified. Some businesses have until 2022 to comply with some exceptions. A new government agency, Halal Products Certification Agency (BPJPH), under the Ministry of Religious Affairs was established to issue the Halal certificates.

Singapore scores high

For the first time, Singapore makes it to the top 10 countries in the GIEI overall ranking; the only non- OIC in the top 10 chart. The country moved up 8 positions to reach an impressive 7th position.

Singapore ranks among the top 10 across all sectors except Islamic finance. The country took the pole position in pharmaceuticals and cosmetics; and was second in Muslim friendly travel and media and recreation. The report explains that this was mostly due to positive growth in exports to OIC countries. Singapore also scored favourably in the awareness sub-indicator, with many educational courses and events carried out across the sectors. With predominantly Muslim neighbouring countries, it has excellent potential to grow further as a leading destination for Muslim-friendly travel. This speaks volumes of the nation’s ambitious attempt to take a big slice of the massive pie.

Notable national Islamic economy strategies that were launched in Asia in recent years included the forging of strategic partnerships between Indonesia and the Philippines to expand their halal trade. KerryDigest also noted Japan and Malaysia inking such a partnership to propel collaboration and growth. Singapore and South Korea, among others, are setting up agreements with OIC countries to explore various partnerships on the import and export of halal products and related services. Thailand is also implementing incentives to encourage investors in the food industry to expand its halal food industry.

Factors leading to growth of the halal industry

Projected robust growth of the halal industry is driven by a number of factors. The increasing Muslim population, rising purchasing power, and the fast growing young Muslim population across Asia are fuelling demands for halal products and services.

Enhanced consumer awareness due to the increasing role of social media and influencers on Islamic lifestyle, innovation and role of technology in the halal industry and the rapid expansion of distribution channels are also often cited as reasons for the rapid escalation of the industry.

There is also the increasing number of Muslim travellers, especially the younger travellers.

Mr Fazal Bahardeen, the founder and chief executive officer of CrescentRating was quoted in a Straits Times article as saying, “Muslim travellers in Southeast Asia have a huge leverage on the recovery of the tourism sector. The region has all the fundamental elements for halal tourism. The market is big enough and the destinations are mostly Muslim-friendly.”

According to the Mastercard-CrescentRating Global Muslim Travel Index (GMTI), the global Muslim market is set for a major rebound in 2023, after the COVID-19 pandemic grounded almost all international flights and tourism over the past 20 months.

Malaysia and Singapore topped the list of the best Muslim-friendly holiday destinations according to this year’s GMTI, with both countries in the top two positions since the index started in 2015. There were some 160 million Muslim travellers in 2019, up from 140 million a year earlier and representing about 10 percent of the global travel industry.

It is no surprise that big players in the food industry are eyeing the booming halal food sector. Japanese seasoning company Ajinomoto invested US$85 million to build a halal production line in Malaysia, due to open by 2022. Other global brands have taken notice of the Muslim economy to capitalize on the purchasing power of those 260 million Muslims who live in the ASEAN region, the majority of whom live in Indonesia, Malaysia, Thailand, the Philippines, Singapore, Myanmar, and Brunei.

The increasing number of halal lifestyle events and campaigns have gone a long way to stimulate interest in Islamic travel, foods, fashion, and cosmetics.

A case in point is Malaysia’s effort to boost the growth of the halal industry to a higher level by introducing the “Make Halal Your First Choice” as one of the programs under the 2022 Budget Initiative. The Halal Development Corporation Berhad’s initiative attracted the participation of 500 halal entrepreneurs from the micro, small and medium enterprise (MSME) sector aiming to increase average sales by 20 to 30 percent during the campaign period from April to July 2022.

Over in Singapore, the halal cosmetics company, Believe, recently raised US$55m in Series C funding led by new investor Venturi Partners. Believe is a house of Muslim audience-focused brands including Lafz, ZM and Dr Rhazes, which offer consumer products spanning skincare, fragrances, make-up and hair care.

Islamic finance has become a US$2 trillion business over the past two decades. Ethis, one of the new fintech providers to come about during the pandemic, became the first fully Shariah compliant equity crowdfunding platform in Malaysia. In Indonesia, tech-based lenders are tapping into Syariah banking, “betting on an underpenetrated market with a potential customer base of 45 million”, a Straits Times article published on 12 March 2022 revealed. The rate for such banking in Indonesia is only 7 percent, a far cry from Malaysia’s 29 percent. The possibility for exponential growth to happen is real

Halal products and services not just for Muslims

The Statistical Economic and Social Research and Training Centre for Islamic Countries (SESRIC) explains that halal products and services are not designed and produced exclusively for Muslims. People of other religions and beliefs are also interested in and do consume halal products and services due to health or ethical concerns.

SESRIC points out that increased global awareness on issues like ‘sustainability’, ‘ethical consumption’ and ‘green growth’ have helped the halal industry to flourish in recent years. As Islam prohibits doing harm to any other people and environment, the halal issues are related to “all steps of a business line such as procuring, production, logistics, marketing, consumption, and waste management.”

Halal food items have evolved from being an identification mark of religious observation to assurance of food safety, hygiene and reliability. A halal food lifestyle study conducted by Mastercard-CrescentRating in Singapore revealed Muslim consumers in the nation have the greatest trust of halal assurance in establishments that have halal certification.

The Islamic Religious Council of Singapore (Muis) recently made it possible for the public to access information about listed foreign halal certification bodies (FHCBs). Previously, the list could be accessed only through a system predominantly used by businesses.

Muis issued a statement saying, “As the sole authority for halal certification in Singapore, Muis plays a vital role in the burgeoning halal food industry with the availability of many halal-certified eating establishments providing dining options for the community. A key part of this is the availability of imported products and materials which are halal and meet the requirements of Muis’ halal certification standards.”

Muis pledged to continue to adopt a robust recognition process of halal certification performed by registered competent bodies based overseas, to ensure continued public confidence in imported ingredients used by halal-certified food establishments and manufacturers in Singapore.

By implementing stringent regulatory frameworks, the halal industry gains the confidence of the consumers; and more businesses will harness their investments to meet the growing demands.

Asia, particularly the ASEAN countries, is gaining a strong foothold in the industry as halal goes global.